SMC India Trading Workshop

- Rs. 199.00

Rs. 499.00- Rs. 199.00

- Unit price

- per

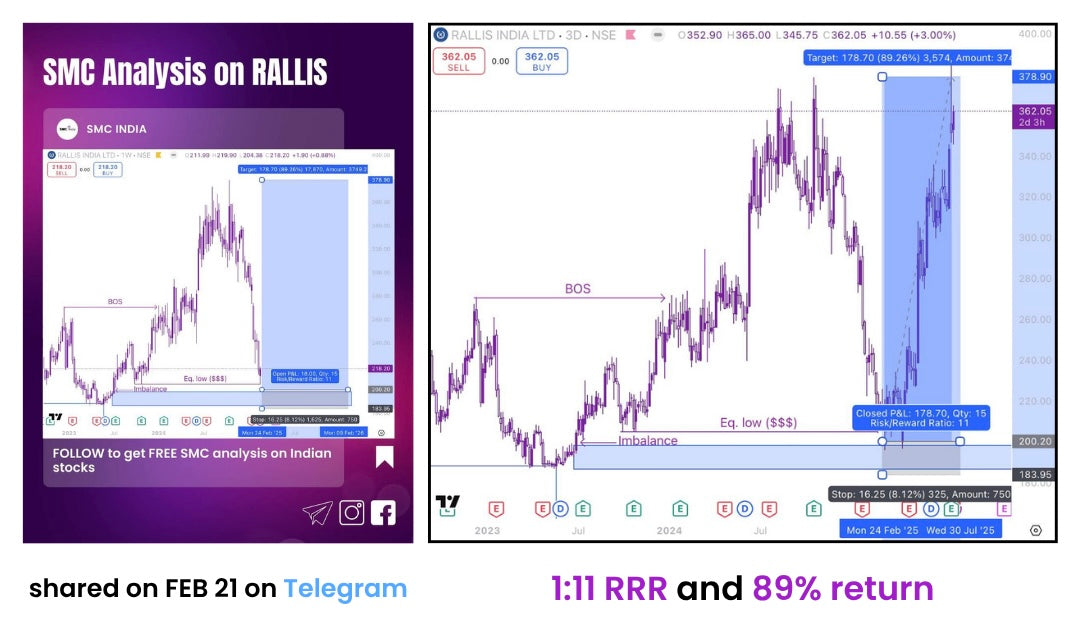

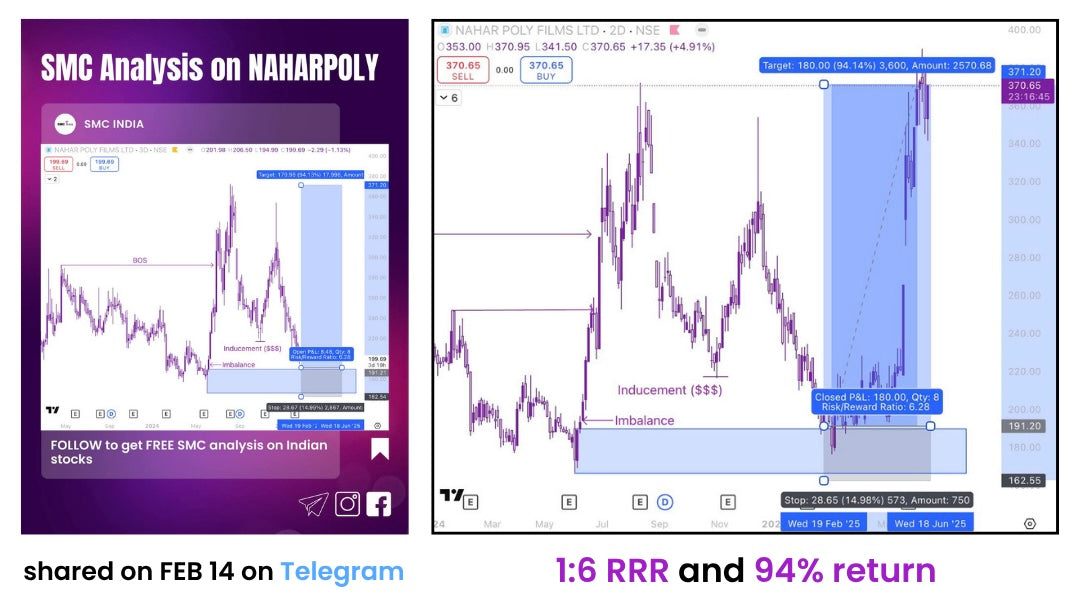

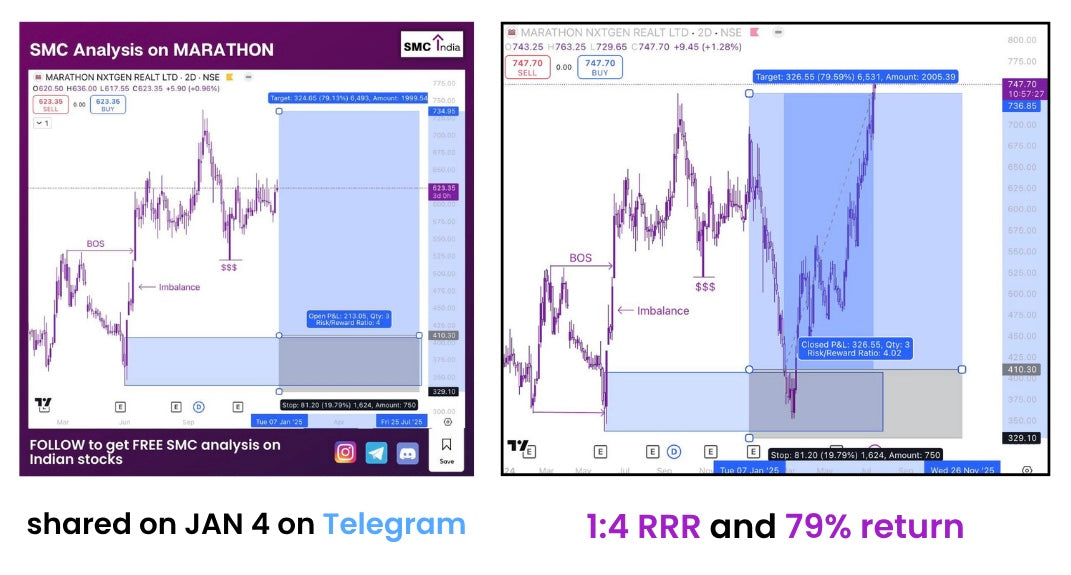

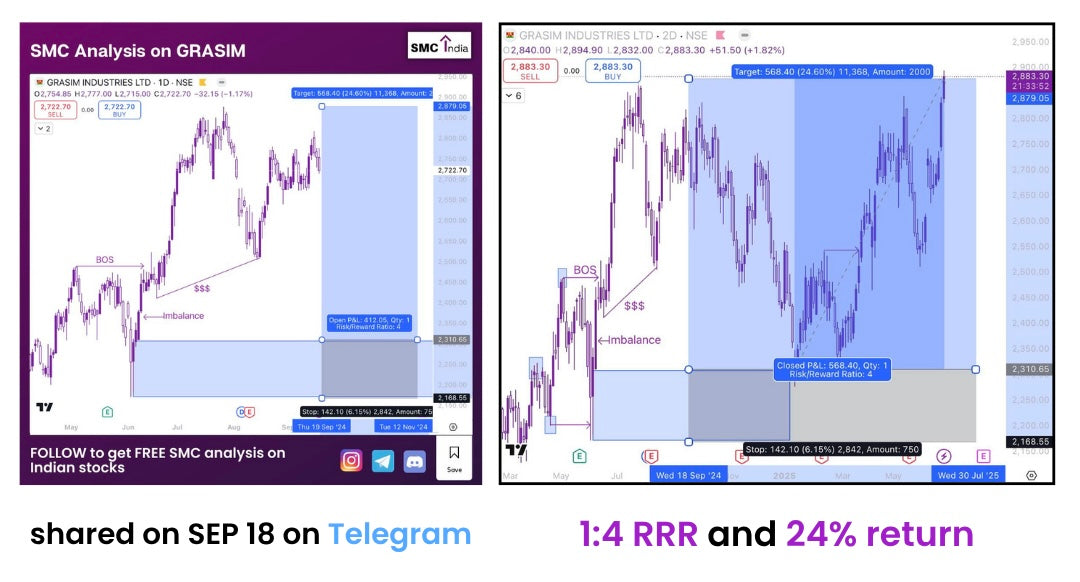

The SMC India Trading Workshop teaches you how institutional F&O traders analyze markets, build positions in options, and apply Smart Money Concepts—giving you a clear framework to trade with precision and confidence.